LS UK Retirement Finance

THE EQUITY RELEASE PARTNERSHIP LIMITED

Company number 05642304

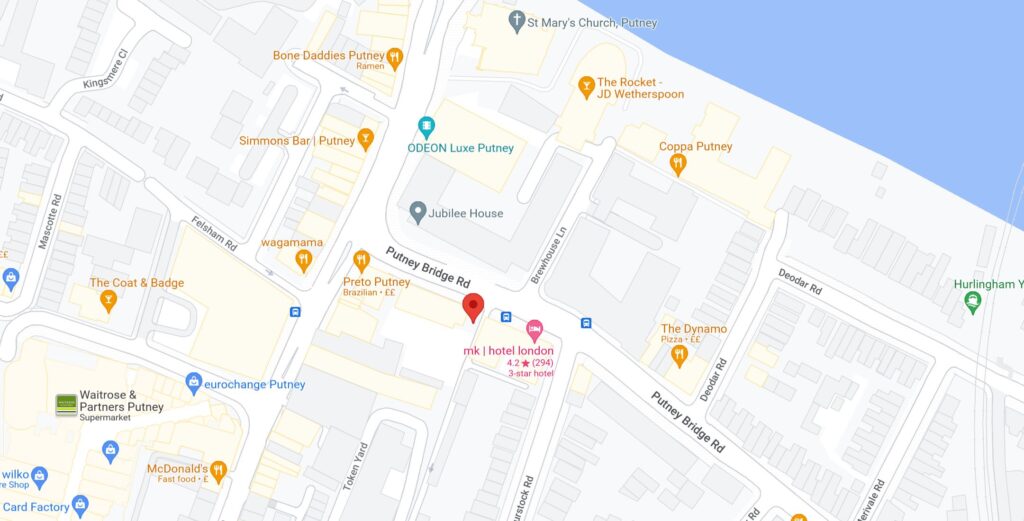

329-339 Putney Bridge Road

Putney

London

SW15 2PG

UK

LS UK Retirement Finance

THE EQUITY RELEASE PARTNERSHIP LIMITED

Company number 05642304

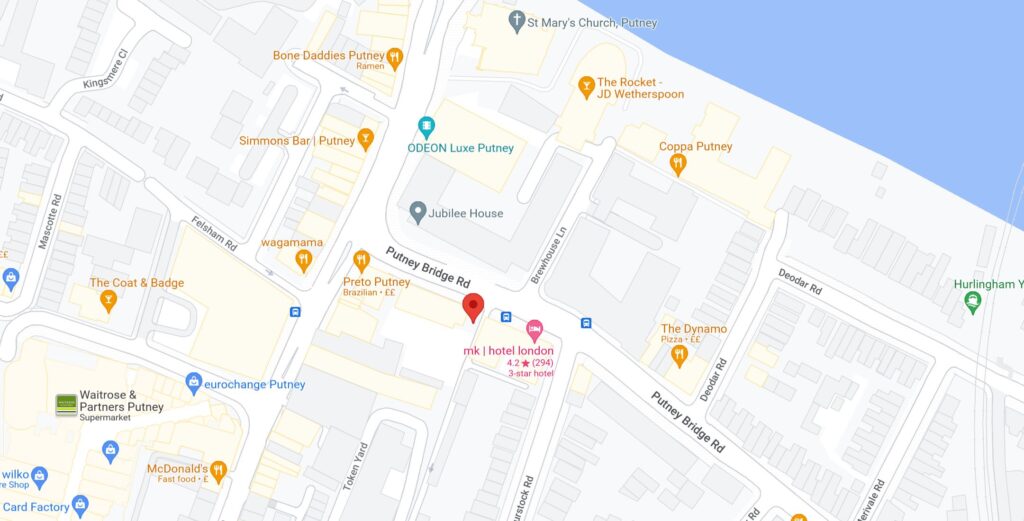

329-339 Putney Bridge Road

Putney

London

SW15 2PG

UK

LS UK Retirement Finance